Introduction to POS Systems

Every modern business needs efficient payment processing and operational management. POS systems have evolved beyond simple cash registers to become comprehensive platforms that handle transactions, inventory, customer data, and analytics. This guide explains what point-of-sale technology is, how it functions, and which system type best fits your business needs.

What is a POS System?

A POS system is the technology platform that enables businesses to process customer transactions and manage core operations from a centralised interface. Point-of-sale systems combine hardware components such as terminals, card readers, and receipt printers with software that handles payments, inventory tracking, sales reporting, and customer relationship management.

The distinction between traditional cash registers and modern POS systems lies in functionality. Cash registers perform basic transaction processing. Point-of-sale systems extend far beyond this, offering inventory management, CRM capabilities, data analytics, security features, and third-party integrations that help businesses operate more efficiently.

For retail stores, F&B outlets, salons, gyms, tuition centres, and service providers, a POS system serves as the operational backbone. Competition and digitalisation have made these platforms essential rather than optional.

Types of POS Systems

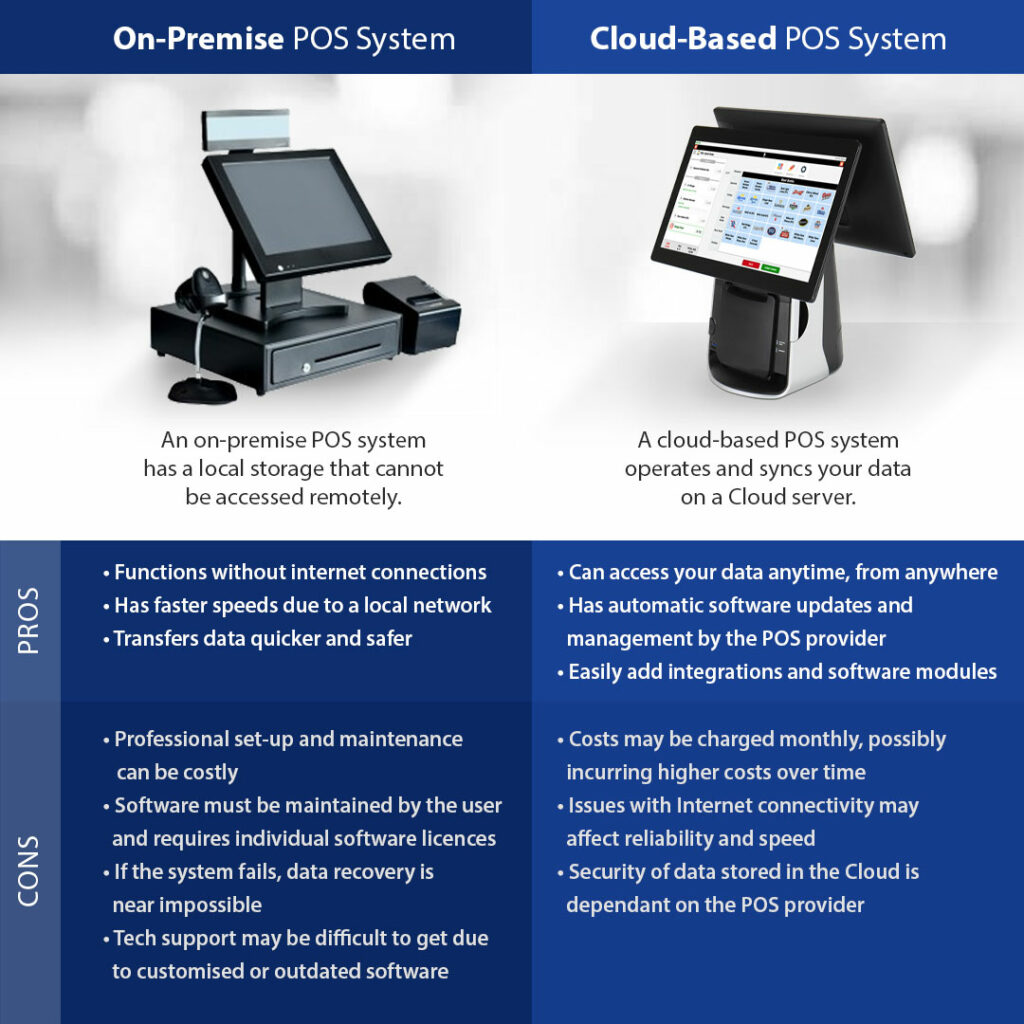

The market offers three main categories of point-of-sale systems: on-premise, cloud-based, and hybrid solutions. Whilst hardware components remain largely consistent across all types, the software architecture determines how each system operates and what benefits it delivers.

On-premise POS systems install software locally on your hardware. Data stays on-site, giving you complete control over your information. These systems require upfront investment in servers and IT infrastructure, but don’t depend on internet connectivity for core functions.

Cloud-based POS systems store data on remote servers accessed through the internet. You can manage your business from any device with web access. These platforms typically operate on subscription models with lower initial costs, automatic updates, and built-in backup systems.

Hybrid POS systems combine elements of both approaches. They function offline when needed but sync data to the cloud when connectivity returns. This structure offers reliability with the flexibility of cloud access.

Your business type and operational requirements determine which system works best. Retail operations may prioritise inventory management and automated stock reordering. Restaurants need table management, kitchen display systems, and online ordering integration. Service businesses benefit from appointment scheduling and client history tracking.

How Point of Sale Systems Process Transactions

POS systems streamline the sales process through a straightforward workflow. When a customer makes a purchase, staff scan or input items into the system. The point-of-sale platform calculates totals, applies any discounts or promotions, and processes payments through integrated card readers or payment gateways.

The system simultaneously updates inventory levels, records transactions in sales reports, and captures customer information for marketing purposes. Receipt generation happens automatically, whether printed or sent digitally.

Beyond basic transactions, modern POS systems offer features that enhance operational efficiency:

Inventory management tracks stock levels in real-time, alerts you when items run low, and can generate purchase orders automatically. This prevents stockouts and reduces excess inventory carrying costs.

Sales reporting and analytics provide insights into revenue trends, best-selling products, peak trading hours, and staff performance. Data-driven decisions replace guesswork in business planning.

Customer relationship management stores purchase history, preferences, and contact details. You can create targeted marketing campaigns, loyalty programmes, and personalised service that increases customer lifetime value.

Employee management tracks work hours, sales performance, and access permissions. You maintain security whilst monitoring productivity across your team.

Multi-location support synchronises data across multiple outlets, giving you consolidated reporting and centralised control over your entire operation.

Choosing the Right POS System for Your Business

Point-of-sale requirements vary significantly across industries. A fashion boutique needs different functionality than a café or fitness studio. Consider these factors when selecting a POS system:

Payment processing capabilities should support all methods your customers prefer, from cash and cards to mobile wallets and contactless payments. Transaction fees and processing speeds affect both customer experience and your profit margins.

Scalability ensures the system grows with your business. Can you add locations, users, or features without replacing the entire platform? Check whether the provider offers modular options that expand as needed.

Integration possibilities matter when you use accounting software, e-commerce platforms, marketing tools, or booking systems. Seamless data flow between applications eliminates manual data entry and reduces errors.

User interface design impacts training time and daily efficiency. Staff should navigate the system intuitively without extensive instruction. Complicated interfaces slow down transactions and frustrate both employees and customers.

Support and training from your POS provider affect how quickly you resolve issues and maximise system capabilities. Look for responsive customer service, comprehensive documentation, and ongoing training resources.

The Investment Value of Point of Sale Technology

Implementing a POS system represents a strategic investment rather than a simple expense. The right platform reduces operational costs through improved efficiency, decreases losses from inventory shrinkage and accounting errors, and increases revenue through better customer service and data-driven decisions.

Small businesses sometimes hesitate due to perceived costs or complexity. However, cloud-based systems have made professional point-of-sale technology accessible at modest monthly fees. The time saved and insights gained typically offset these costs within months.

Security also deserves consideration. Modern POS systems include encryption, user access controls, and compliance with payment card industry standards. These features protect your business and customer data far better than manual processes or outdated equipment.

Taking the Next Step

Understanding POS systems helps you make informed decisions about business technology. Whether upgrading from a cash register or replacing an outdated system, knowing the types available and how they function guides you towards the right solution.

Evaluate your specific business needs, budget constraints, and growth plans—request demonstrations from providers to see systems in action. Ask about implementation timelines, training processes, and ongoing support arrangements.

The right point-of-sale system doesn’t complicate your operations—it simplifies them. Efficient transaction processing, accurate inventory tracking, and actionable business insights become standard when you choose technology that matches your business requirements.

• Written by Adrija Chakravarti

Interested to see what EPOS POS system can do for your business? Fill in your contact details and we’ll reach out to you to schedule a demo.