No products in the cart.

Whether you are a consumer or a producer, taxes will always be a constant come what may. Taxes are defined as a mandatory contribution to state revenue levied by the government on workers’ income and business profits, or added to the cost of some goods, services and transactions. In this blog I will be covering 2 different ways to calculate your taxes. The IRAS Website lists both these methods as acceptable but your chosen method must be employed consistently. The methods are as follows:

- Method 1 – Total amount payable for all items (excluding GST) x 9%

- Method 2 – Summation of GST amount based on individual line item calculation

Some businesses may round their bills to the nearest 5 cents to facilitate cash payment by their customers. Whether a bill should be rounded up or rounded down to the nearest five cents is a business decision. You may refer to this link to find out more:

Contents hide

Method 1

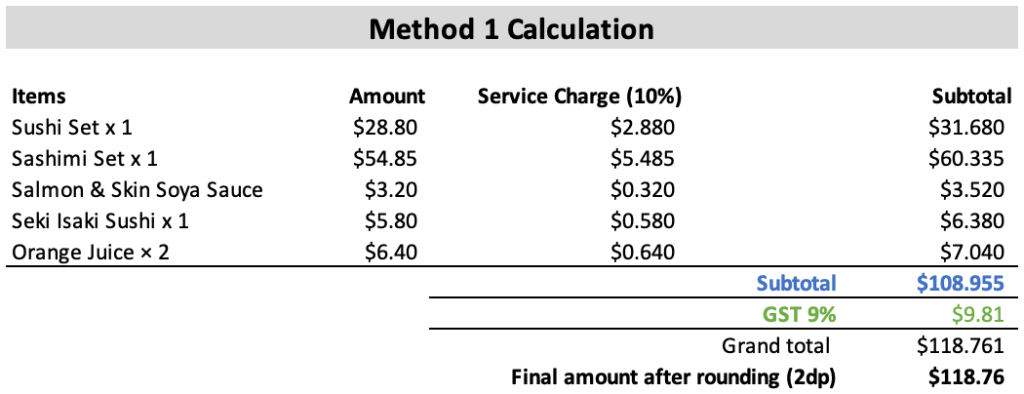

The table above shows an example of how Method 1 is used to calculate the taxes. Method 1 takes the total amount payable for all items and then applies the relevant taxations to the total. The subtotal of these amounts equals $108.955.

- For Service-related Industries such as F&B, Spas and Beauty & Wellness, a service charge to the tune of 10% may be imposed depending on the company. In this case, the charge would be $9.91 (10% of $99.05, to the nearest cent).

- Next a GST charge of 9% is levied on the total of the subtotal and the service charge. This is because the service charge takes precedence over the GST. In this case the GST amounts to $7.63 ($99.05 + $9.905 = $108.955, 9% of $108.955, round off to the nearest cent).

- You would then obtain the total sum of $118.76 by adding the subtotal, service charge and GST.

- To obtain the final amount, rounding down will get you $118.76

There will be no service charge and hence the GST would be applied to just the sum for non Service-related Industries such as Retail.

Method 2

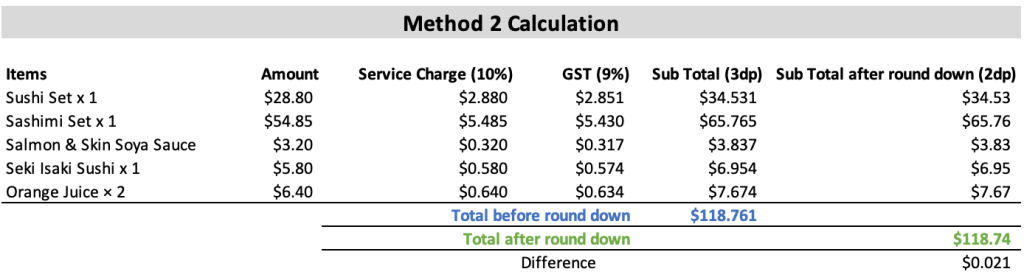

Method 2 meanwhile, applies the taxations to each individual item and the total is obtained from the summation of individual line item after respective rounding.

Let’s take a look at the sushi set, which is the first item, where the base price of the item is $28.80.

- The 10% service charge would amount to $2.880 (10% of $28.80).

- The GST is then taxed on the total of the base sum and the service charge which would be $2.82 ($28.80 + $2.880 = $31.68, 9% of $31.68, round off to the nearest cent).

- Then, obtain the total sum of $34.531 by adding the base sum, service charge and GST.

- Lastly, by rounding down to the nearest 5 cents you would obtain the final amount of $34.53. Repeat this process for the rest of the items and total it. Then, add the total of the round down column and compare the 2 totals.

For non Service-related Industries such as Retail, there will be no service charge and hence the GST would be applied to just the sum. Repeat this process to obtain the total bill and the rounded off total.

When comparing these two methods, it is evident that Method 2 involves rounding down to a more extensive degree compared to Method 1.

Conclusion

If you are in the market for a POS system, look no further than EPOS! Our system uses Method 2 in calculating taxes. Our features are certain to suit your needs and an EPOS system only starts from $300 NET after grants! Do contact us for further information!

Interested to see what EPOS POS system can do for your business? Fill in your contact details and we’ll reach out to you to schedule a demo.

Was this article helpful?

YesNo